ETR: ADS – A Deep Dive into Adidas Stock (ADS.DE) 2025

When it comes to the stock market, ETR: ADS represents Adidas AG, the global sportswear giant listed on the Frankfurt Stock Exchange (ETR) under the ticker symbol ADS. Adidas is one of the world’s largest sportswear brands, competing with Nike and Puma, making its stock an interesting choice for investors.

In this article, we will explore everything about ETR: ADS, including Adidas’ stock performance, financials, growth potential, risks, and whether it’s a good investment in 2025.

What is ETR: ADS?

Understanding the Stock Symbol

- ETR refers to the Frankfurt Stock Exchange (XETRA), one of Europe’s largest stock exchanges.

- ADS is the stock ticker symbol for Adidas AG, the German multinational corporation known for sportswear, sneakers, and accessories.

Adidas is a household name, and its stock has gained attention from both retail and institutional investors.

Adidas AG – A Quick Overview

- Founded: 1949 by Adolf Dassler

- Headquarters: Herzogenaurach, Germany

- Industry: Sportswear & Apparel

- Market Capitalization: Over €30 billion (as of recent data)

- Competitors: Nike, Puma, Under Armour, New Balance

Adidas dominates the global sportswear market, making ETR: ADS an attractive stock for investors looking at the retail and apparel sector.

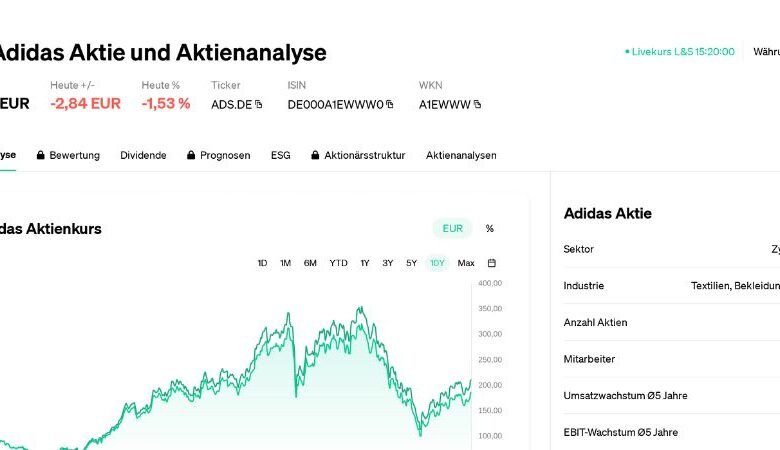

ETR: ADS Stock Performance and History

Adidas Stock Growth Over the Years

Adidas’ stock has seen major fluctuations over the past decade. Some key highlights include:

- 2015-2019: Adidas saw a bullish trend, with stock prices soaring due to strong revenue growth.

- 2020 (Pandemic Crash): Like most companies, Adidas’ stock dropped but rebounded quickly due to strong online sales.

- 2021: The company experienced record revenue growth as global markets recovered.

- 2022-2023: Adidas stock faced declines due to the split with Kanye West’s Yeezy brand, supply chain issues, and inflation concerns.

- 2024-Present: The company is in recovery mode, with efforts to rebuild revenue and improve margins.

Recent Stock Performance

- The current ETR: ADS stock price hovers around €150-€200 (check latest data).

- Adidas has seen moderate growth in 2024, driven by improved global demand and cost-cutting measures.

Why Investors Are Interested in ETR: ADS?

Adidas is a well-established brand, but why should investors pay attention to ETR: ADS? Here are some key reasons:

1. Strong Brand and Global Presence

- Adidas is a market leader in sportswear, with millions of loyal customers worldwide.

- The company has strong brand recognition, which gives it a competitive edge.

2. Digital Expansion & E-commerce Growth

- Adidas is shifting its focus toward direct-to-consumer (DTC) sales, reducing dependency on third-party retailers.

- The company’s online sales have seen strong double-digit growth in recent years.

3. Adidas’ Sustainability Strategy

- Adidas is investing heavily in sustainable materials and eco-friendly production, which aligns with consumer trends.

- The company plans to use recycled materials in 90% of its products by 2025.

4. Potential for Dividend Growth

- Adidas pays dividends to its shareholders, making it a stable investment for those seeking passive income.

- The dividend yield has remained between 1%-2%, with potential for future increases.

Financial Analysis of ETR: ADS

Before investing in ETR: ADS, it’s crucial to look at Adidas’ financial health.

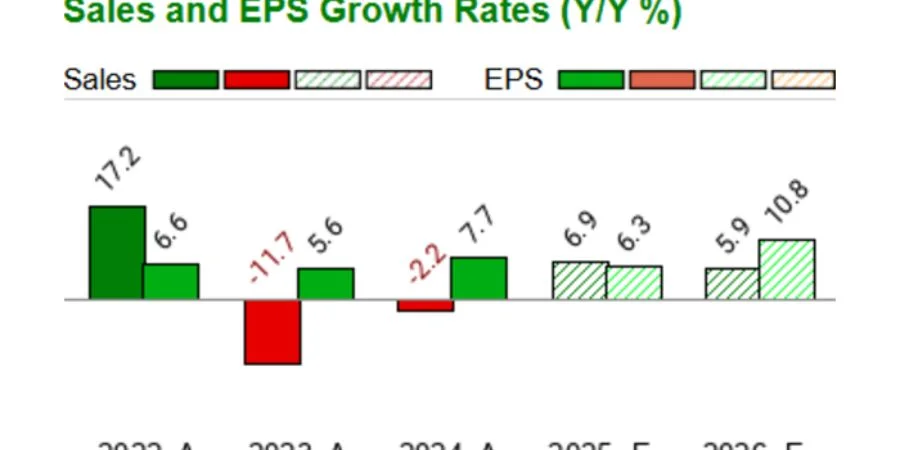

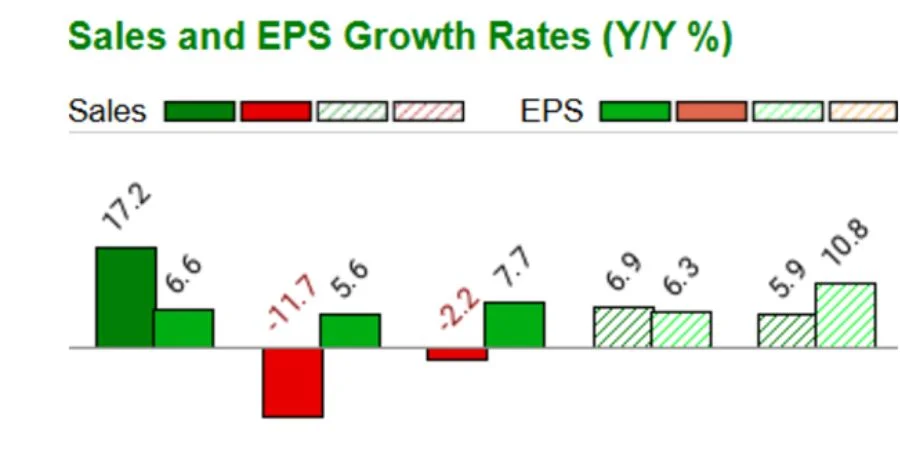

Revenue and Earnings Growth

- 2023 Revenue: Around €22 billion

- 2024 Estimated Revenue: Expected to grow by 5-8% due to strong demand.

- Profit Margins: Adidas has maintained a gross margin of ~49%, but operating margins have fluctuated.

Balance Sheet Strength

- Debt Levels: Adidas has some debt but maintains a healthy balance sheet.

- Cash Reserves: The company has strong liquidity, ensuring financial stability.

Valuation & P/E Ratio

- Adidas’ Price-to-Earnings (P/E) ratio is currently around 25-30, which is considered reasonable for a growth stock.

- Compared to Nike (NKE), which trades at a P/E of 30-35, Adidas stock appears fairly valued.

Risks of Investing in ETR: ADS

While ETR: ADS has strong growth potential, it’s important to consider the risks:

1. Competition from Nike and Puma

- Nike remains the biggest competitor, consistently outperforming Adidas in the U.S. market.

- Puma is also expanding aggressively, increasing competition in Europe and Asia.

2. Macroeconomic Challenges

- Inflation and rising costs could impact Adidas’ profit margins.

- Supply chain issues remain a concern, although Adidas is improving logistics.

3. Brand Controversies

- Adidas faced backlash after cutting ties with Kanye West’s Yeezy line, impacting revenue.

- Any future brand controversy could affect stock performance.

Is ETR: ADS a Good Investment in 2025?

Adidas is currently in recovery mode, making ETR: ADS a potentially profitable long-term investment. However, investors should weigh the pros and cons before making a decision.

Reasons to Buy

✅ Strong brand loyalty and global presence

✅ Growing digital sales and direct-to-consumer strategy

✅ Focus on sustainability and innovation

✅ Potential for dividend growth

Reasons to Avoid

❌ Intense competition from Nike, Puma, and Under Armour

❌ Economic uncertainties and inflation risks

❌ Recent Brand Controversies Affecting Investor Confidence

For investors with a long-term outlook, ETR: ADS offers good growth potential, but short-term risks remain.

Conclusion

ETR: ADS (Adidas AG stock) is a strong player in the sportswear industry with huge brand value and growth opportunities. However, investors must consider market risks, competition, and economic factors before making a decision.

If you believe in Adidas’ long-term vision, investing in ETR: ADS could be a rewarding move. But if you prefer a safer bet, waiting for better entry points may be wise.

Would you invest in ETR: ADS? Let us know your thoughts!

FAQs

Q: What does ETR: ADS mean?

A: ETR: ADS refers to Adidas AG’s stock listed on the Frankfurt Stock Exchange (XETRA) under the ADS ticker.

Q: Is Adidas a profitable company?

A: Yes, Adidas is profitable, with strong revenue growth and brand value, but faces competition from Nike.

Q: Does Adidas pay dividends?

A: Yes, Adidas pays dividends, making it a good stock for income investors.

Q: How does Adidas compare to Nike?

A: Nike has a higher market share, but Adidas is growing its direct-to-consumer segment rapidly.

Q: Is ETR: ADS a good stock to buy?

A: It depends on your investment goals. Adidas has growth potential, but short-term risks exist.

Go to Home Page for More Information