SLNA Stock: A Complete Guide for Investors 2025

Selina Hospitality PLC, trading under SLNA stock, has caught the attention of investors looking for high-growth potential in the hospitality sector. Known for its unique approach to travel, Selina combines accommodation, co-working spaces, and local experiences in one place. But does this make it a good investment?

In this article, we will analyze SLNA stock, its financial performance, recent developments, and whether it holds promise for investors.

What is Selina Hospitality (SLNA)?

Founded in 2014, Selina Hospitality PLC is a fast-growing hospitality brand targeting millennials and Gen Z travelers. The company provides affordable stays with co-working spaces, cultural experiences, and entertainment. With locations in 24 countries and 118 destinations, Selina markets itself as the ultimate travel experience for digital nomads and backpackers.

Selina went public via the SPAC (Special Purpose Acquisition Company) merger in 2022, listing on NASDAQ under SLNA stock. However, since its debut, the stock has struggled, and investors are wondering about its future.

SLNA Stock Financial Overview

Before investing in SLNA stock, it’s important to analyze its financials.

Key Financials (Latest Data as of 2025)

- Stock Price: $0.037

- Market Cap: $16.3 million

- 2022 Revenue: $183.94 million (98.34% increase from 2021)

- Net Loss: $197.11 million (6.92% higher than 2021)

- 52-Week High: $0.651

- 52-Week Low: $0.03

Selina has shown strong revenue growth, but its losses remain a concern. The company has been expanding aggressively, but profitability remains a key challenge.

Why is SLNA Stock Struggling?

1. Heavy Losses and Cash Burn

Selina is growing fast but at a high cost. The company spends heavily on expanding its network of hotels, marketing, and digital infrastructure. In 2022 alone, it lost nearly $200 million, raising concerns about long-term sustainability.

2. Delisting Warning from NASDAQ

In April 2024, SLNA stock received a delisting notice from NASDAQ for failing to maintain the minimum bid price requirement of $1. The company announced plans to appeal and is considering a reverse stock split to regain compliance.

3. High Volatility and Investor Caution

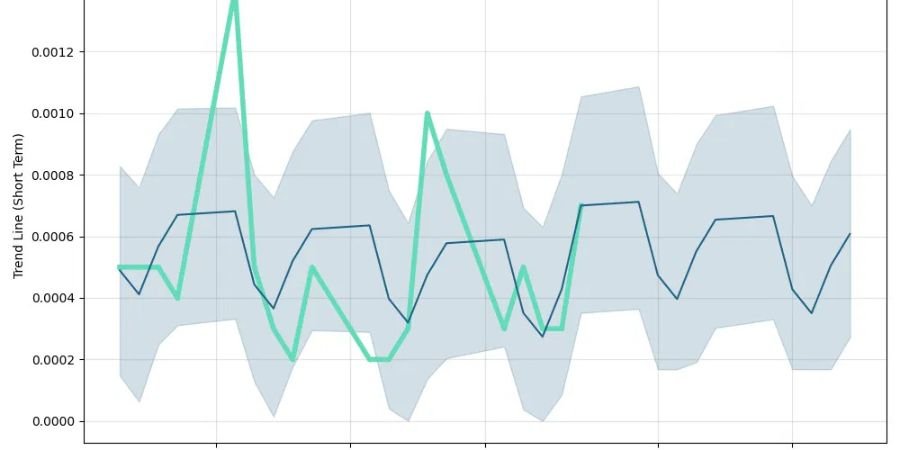

SLNA stock has been extremely volatile, with a 52-week range between $0.03 and $0.65. Such movements indicate high risk, making it a speculative investment rather than a stable one.

Recent Developments for SLNA Stock

1. Focus on Digital Nomads

Selina launched its “Work Everywhere” campaign, targeting remote workers and freelancers. By offering co-working spaces within hotels, they aim to attract a new wave of long-term travelers.

2. Sustainability and Social Impact

Selina is heavily investing in sustainability, organizing beach clean-ups, and eco-friendly initiatives, and supporting local businesses. These efforts enhance its brand image but have yet to translate into profitability.

3. Cost-Cutting and Debt Reduction

To address financial challenges, Selina is restructuring its operations by:

- Reducing underperforming locations

- Negotiating better rental agreements

- Seeking additional funding and partnerships

While these efforts are positive, investors need to see clear results in the company’s next earnings reports.

SLNA Stock Price Predictions and Forecast

Investors are curious whether SLNA stock has growth potential or if it’s a risky bet. Analysts provide mixed opinions:

- Bullish Case: Some experts predict a long-term price target of $4.59, assuming Selina successfully cuts costs and improves profitability.

- Bearish Case: Others believe SLNA stock is too risky due to its continuous losses and delisting concerns, warning that the stock could remain below $1.

For now, SLNA stock remains speculative, and investors should be cautious.

Should You Invest in SLNA Stock?

Investing in SLNA stock comes with high risks and potential rewards. Here’s a breakdown:

Reasons to Consider Buying SLNA Stock

✔ Strong Revenue Growth – The company’s revenue has grown significantly year over year.

✔ Unique Business Model – Selina’s focus on digital nomads and experiences sets it apart.

✔ Potential for Recovery – If Selina executes its turnaround strategy, SLNA stock could rise.

Reasons to Avoid SLNA Stock

❌ Heavy Losses – The company has yet to achieve profitability.

❌ Delisting Risk – If NASDAQ removes SLNA stock, it will trade on the OTC (Over-the-Counter) market, which has lower liquidity.

❌ Stock Volatility – The price swings make SLNA stock risky for conservative investors.

Verdict: SLNA stock is a high-risk, high-reward investment. Only invest if you believe in Selina’s long-term vision and can handle short-term volatility.

Conclusion

Selina Hospitality is an innovative hospitality brand with strong revenue growth, but financial losses and stock volatility remain major concerns. Investors should closely monitor the company’s cost-cutting strategies and NASDAQ compliance efforts before making an investment decision.

For those seeking a speculative opportunity, SLNA stock could offer gains if Selina successfully turns its business around. However, caution is advised until the company shows clear signs of profitability.

FAQs

Q: What does SLNA stand for?

A: SLNA is the ticker symbol for Selina Hospitality PLC, a travel and hospitality company.

Q: Why is SLNA stock so cheap?

A: SLNA stock is trading below $1 due to high losses, financial struggles, and a delisting warning from NASDAQ.

Q: Can SLNA stock recover?

A: It is possible if Selina successfully cuts costs, improves profitability, and regains NASDAQ compliance. However, the risk remains high.

Q: Should I invest in SLNA stock?

A: SLNA stock is highly speculative. If you believe in the company’s future and can handle volatility, it could be worth considering. However, there are safer investment options available.

Q: Where can I buy SLNA stock?

A: You can buy SLNA stock through major brokerage platforms like Robinhood, E-Trade, and TD Ameritrade.

Go to Home Page for More Information