Meta Earnings: A Deep Dive into the Company’s Latest Financial Performance

Meta, the tech giant behind Facebook, Instagram, and WhatsApp, has again released its highly anticipated earnings report. Investors, analysts, and tech enthusiasts eagerly wait for Meta earnings each quarter to understand the company’s financial health and future direction.

In this article, we’ll look at Meta’s Q4 and full-year 2024 earnings, analyzing its revenue, profits, and key business segments. We’ll also explore how Meta’s investments in artificial intelligence (AI), advertising, and the metaverse have impacted its financial performance.

Additionally, we’ll compare Meta’s earnings with market expectations, review investor reactions, and discuss the company’s long-term strategy. By the end of this article, you’ll have a clear understanding of Meta’s financial standing and its potential for future growth.

Meta’s Q4 and Full-Year 2024 Earnings Report

Meta’s latest earnings report reveals strong growth in several areas despite challenges in the tech industry. Here’s a breakdown of the key numbers from the report:

1. Revenue and Profit Growth

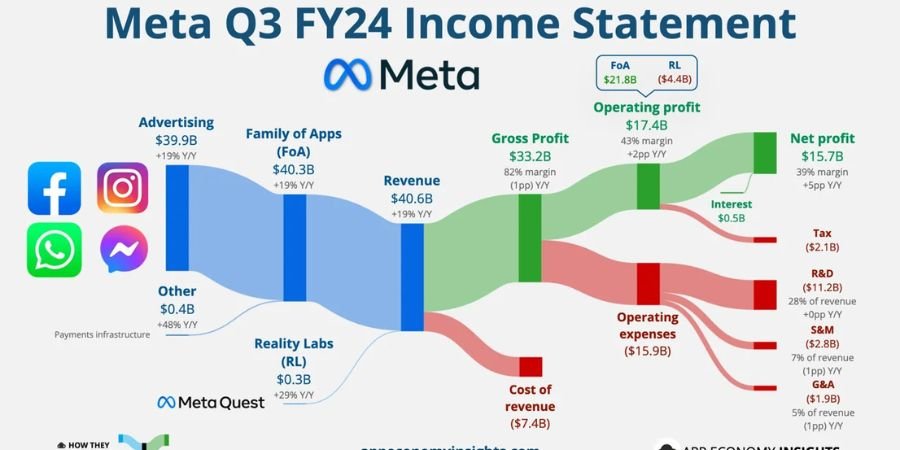

Meta reported a total revenue of $40.1 billion for Q4 2024, reflecting a 15% year-over-year increase. For the full year, revenue reached $125.8 billion, up from $117 billion in 2023.

- Net income for Q4 surged to $14.8 billion, a 23% increase from the previous year.

- Earnings per share (EPS) stood at $5.35, surpassing analyst expectations.

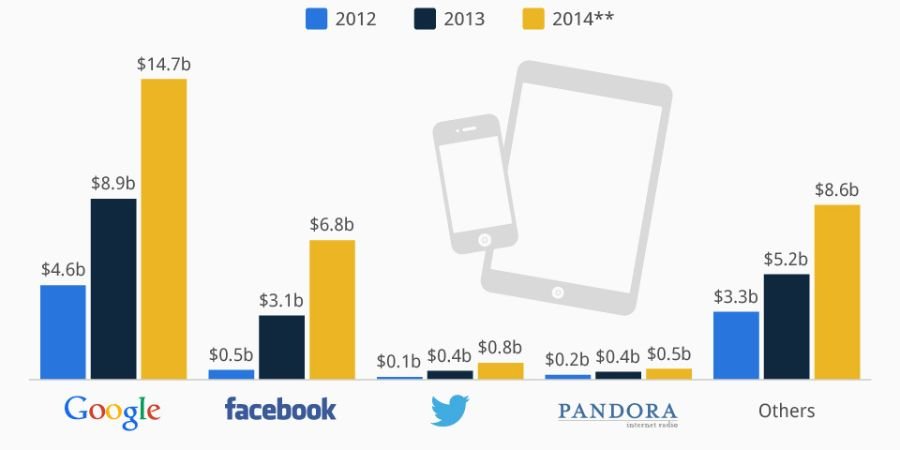

2. Advertising Revenue Dominates

Advertising remains Meta’s primary revenue driver, contributing over 90% of its total earnings. Key factors behind the strong ad revenue growth include:

- Improved AI-driven ad targeting across Facebook and Instagram.

- Higher engagement on Reels, Stories, and Video Ads.

- Stronger demand from e-commerce and retail advertisers.

Meta’s AI-powered ad recommendations have helped businesses achieve higher returns on ad spend (ROAS), increasing ad budgets on the platform.

3. Reality Labs: The Metaverse Investment Continues

Meta’s metaverse division, Reality Labs, reported a $4.6 billion loss in Q4, bringing its total 2024 losses to $16.1 billion. Despite these losses, CEO Mark Zuckerberg remains committed to long-term investments in VR (virtual reality) and AR (augmented reality).

Key highlights from Reality Labs:

- Strong sales of Meta Quest 3, the latest VR headset.

- Ongoing development of the Metaverse social experience.

- Increased spending on AI-powered avatars and mixed-reality applications.

4. Daily Active Users (DAUs) and Engagement Growth

Meta reported 3.19 billion daily active users (DAUs) across all platforms (Facebook, Instagram, WhatsApp), an increase of 6% year-over-year.

- Facebook alone grew to 2.1 billion DAUs.

- Reel engagement surged, with users spending 35% more time watching short-form videos.

- WhatsApp Business adoption grew, driving more revenue through messaging tools.

What Drove Meta’s Financial Performance?

Meta’s strong earnings performance in Q4 2024 was driven by several key factors:

1. AI-Powered Advertising & Monetization

Meta’s investment in artificial intelligence has significantly improved ad targeting and engagement. The company’s Advantage+ AI system helps advertisers optimize campaigns, leading to better conversion rates.

2. Cost Efficiency & Layoffs Impact

In 2023 and early 2024, Meta undertook significant cost-cutting measures, including layoffs of over 20,000 employees. This reduced operating costs and improved overall profitability.

- Operating expenses declined by 12%.

- Higher productivity with fewer employees.

3. Strong Performance of Instagram and WhatsApp

- Instagram Reels is gaining popularity, rivaling TikTok in engagement.

- WhatsApp’s business tools are now generating more revenue from small and medium businesses.

Meta’s ability to monetize these platforms has played a crucial role in driving Meta earnings higher.

Stock Market Reaction

Following the earnings announcement, Meta’s stock price saw a strong surge, rising 8% in after-hours trading. Investors reacted positively to:

- Higher-than-expected revenue and profit.

- Strong growth in ad revenue and engagement.

- Meta’s cost-cutting efforts improve profitability.

Analyst Opinions on Meta Stock

- Goldman Sachs: “Meta’s AI-driven ad strategy is working exceptionally well.”

- Morgan Stanley: “Reality Labs’ losses are concerning, but Meta’s core business remains strong.”

- JP Morgan: “Meta earnings exceeded expectations, making it a strong investment.”

Meta’s Future Growth Strategy

Meta’s long-term strategy focuses on three major areas:

1. AI and Machine Learning

Meta plans to expand AI capabilities in content recommendations, ad optimization, and customer support.

- AI-generated content to improve user engagement.

- AI-driven messaging bots for businesses on WhatsApp.

2. Metaverse and Reality Labs

Despite Reality Labs’ losses, Meta remains committed to:

- Developing next-gen VR/AR headsets.

- Expanding Horizon Worlds, its metaverse platform.

- Exploring AI-driven 3D avatars for virtual meetings.

3. Monetization of WhatsApp & Instagram

- Paid features on WhatsApp for businesses.

- More shoppable content on Instagram to boost e-commerce revenue.

By focusing on these areas, Meta aims to sustain long-term earnings growth.

Conclusion

Meta had a strong earnings report, showing big growth in revenue, profit, and user numbers. The company made more money from ads, and people are spending more time on Instagram Reels and WhatsApp. Even though Reality Labs lost money, Meta is still working hard on the metaverse and AI technology.

Looking ahead, Meta plans to improve AI, advertising, and virtual reality to keep growing. Investors were happy with the results, and the stock price went up. While there are challenges, Meta’s future looks bright as it keeps building new tech and better user experiences.

FAQs

Q: How much money did Meta make in Q4 2024?

A: Meta made $40.1 billion in revenue, which is 15% more than last year.

Q: What is the biggest way Meta earns money?

A: Most of Meta’s money comes from advertising on Facebook, Instagram, and WhatsApp.

Q: Did Meta’s stock price go up after the earnings report?

A: Yes, the stock price jumped 8% because the earnings were better than expected.

Q: How many people use Meta’s platforms every day?

A: Around 3.19 billion people use Facebook, Instagram, and WhatsApp daily.

Q: Is Meta still working on the metaverse?

A: Yes, even though Reality Labs lost $16.1 billion, Meta is still investing in VR and AR.

Q: What is Meta’s plan for the future?

A: Meta wants to improve AI, grow ads, and make VR/AR technology better.

Q: Why is AI important for Meta’s business?

A: AI helps Meta show better ads, recommend content, and improve user experience.

Go to Home Page for More Information