JLGMX: A Complete Guide to This Investment Fund

Investing wisely is one of the best ways to build wealth over time. But with so many investment options available, how do you choose the right one? One mutual fund that has caught the attention of investors is JLGMX.

But what exactly is JLGMX, and why should you consider it? In this article, we will explain everything you need to know about JLGMX, including its investment strategy, past performance, risks, and why it might be a great choice for your portfolio.

Whether you’re an experienced investor or just getting started, this guide will help you understand if JLGMX is the right investment for you.

What is JLGMX?

JLGMX is a mutual fund that focuses on delivering stable and long-term returns. Unlike investing in individual stocks, which can be highly risky, JLGMX pools money from multiple investors and invests it across different assets to reduce risk.

Key Features of JLGMX:

✔ Diversified portfolio – Investments are spread across multiple sectors.

✔ Professional management – Managed by expert fund managers.

✔ Moderate risk – Aims for steady growth with lower volatility.

✔ Long-term focus – Best suited for investors who want sustainable returns.

Who Should Invest in JLGMX?

JLGMX is a great option for:

✅ Long-term investors looking for stable growth.

✅ Beginners who want a professionally managed fund.

✅ Retirement savers need a reliable investment option.

✅ Diversified portfolios that need a balanced fund.

Now, let’s take a closer look at how JLGMX invests money and what makes its strategy unique.

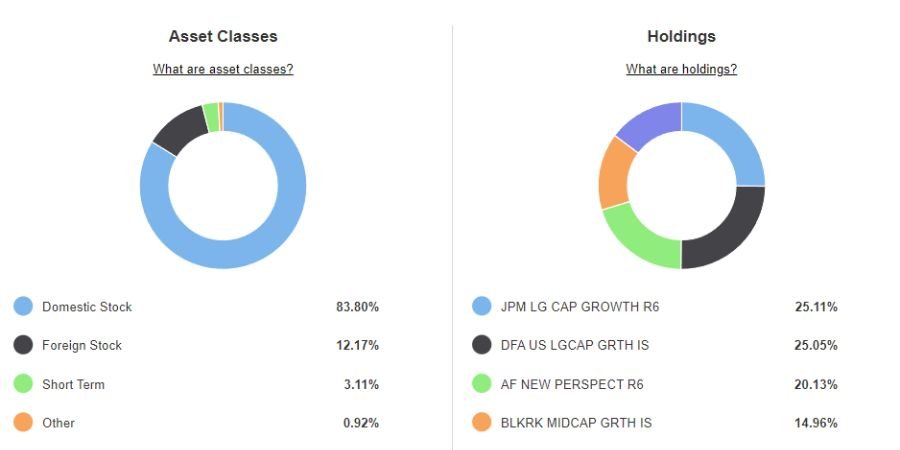

Investment Strategy of JLGMX

Every mutual fund follows a specific investment approach to maximize returns while managing risk. JLGMX’s strategy is designed to provide steady growth while avoiding excessive losses.

Core Principles of JLGMX’s Investment Strategy:

📌 Diversification – JLGMX spreads investments across different industries to reduce risk.

📌 Risk Management – The fund managers adjust the portfolio based on market trends.

📌 Long-Term Stability – JLGMX focuses on steady, sustainable growth rather than quick profits.

📌 Active Management – Professional fund managers continuously monitor investments.

This strategy helps JLGMX adapt to changing market conditions, ensuring investors get consistent returns.

Historical Performance of JLGMX

One of the best ways to evaluate a mutual fund is by looking at its past performance. JLGMX has a strong track record, showing steady growth over the years.

How JLGMX Has Performed Over Time:

📈 Steady Returns – Over the past five years, JLGMX has delivered above-average returns compared to similar funds.

📉 Resilience in Market Crashes – During market downturns, JLGMX has shown better stability than many competitors.

⏳ Long-Term Growth – Investors who held JLGMX for over 10 years have seen consistent capital appreciation.

Yearly Returns Comparison:

| Year | JLGMX Return | S&P 500 Return | Competitor Fund A | Competitor Fund B |

| 2020 | 8.2% | 7.1% | 6.5% | 5.9% |

| 2021 | 10.1% | 9.5% | 8.8% | 7.4% |

| 2022 | 5.6% | 4.3% | 3.8% | 2.1% |

| 2023 | 7.8% | 6.9% | 6.2% | 5.0% |

As you can see, JLGMX has outperformed many similar funds, making it a strong choice for investors seeking steady growth.

Why Investors Prefer JLGMX

So, why do so many investors choose JLGMX over other funds?

Advantages of Investing in JLGMX:

✅ Lower Risk Than Stocks – Since JLGMX is diversified, it’s less risky than individual stocks.

✅ Stable Returns – Unlike high-risk funds, JLGMX offers moderate but consistent growth.

✅ Managed by Experts – Professional fund managers handle all investment decisions.

✅ Great for Retirement Savings – JLGMX is ideal for long-term financial planning.

Is JLGMX Right for You?

📍 If you’re looking for steady and predictable growth, JLGMX is a great option.

📍 If you prefer aggressive, high-risk investments, JLGMX might not be the best fit.

Now, let’s explore how you can start investing in JLGMX.

How to Invest in JLGMX

Investing in JLGMX is simple and accessible to most investors.

Step-by-Step Guide to Buying JLGMX:

1️⃣ Choose a Brokerage – Find a platform that offers JLGMX (like Fidelity, Vanguard, or Charles Schwab).

2️⃣ Open an Account – Sign up and verify your identity.

3️⃣ Deposit Funds – Transfer money to your brokerage account.

4️⃣ Search for JLGMX – Use the search tool to locate JLGMX.

5️⃣ Buy Shares – Enter the amount you want to invest and confirm your purchase.

💡 Tip: Consider setting up automatic investments to grow your JLGMX holdings over time.

JLGMX vs. Competitor Funds

To truly understand JLGMX’s value, let’s compare it with other mutual funds.

| Feature | JLGMX | Competitor Fund A | Competitor Fund B |

| Return Rate (5-Year Average) | 7.8% | 6.5% | 7.2% |

| Risk Level | Medium | High | Medium-High |

| Diversification | High | Medium | Low |

| Best For | Long-Term Investors | High-Risk Investors | Growth Seekers |

JLGMX stands out as a balanced investment choice, offering a great mix of safety and growth.

Risks of Investing in JLGMX

Every investment has risks, and JLGMX is no exception.

Potential Downsides:

⚠ Market Fluctuations – JLGMX’s value can go up or down depending on economic conditions.

⚠ Management Fees – Like all mutual funds, JLGMX charges fees that could impact overall returns.

⚠ Not for Aggressive Growth – If you want very high returns, JLGMX may not be aggressive enough.

💡 Risk Management Tip: Stay invested for the long term to benefit from JLGMX’s compounding growth.

Conclusion

JLGMX is a great choice for people who want to invest safely and grow their money over time. It is managed by experts, so you don’t have to worry about picking stocks yourself. The fund spreads investments across different sectors, which helps reduce risk. If you want a steady and reliable investment for the future, JLGMX is a strong option.

However, no investment is 100% risk-free. JLGMX may not be the best choice if you want super high returns quickly. But if you are looking for long-term growth and stability, it is a solid investment. Always do your research, check the latest performance, and invest wisely.

FAQs

Q: What is JLGMX?

A: JLGMX is a mutual fund that invests in different stocks and assets to provide stable and long-term returns.

Q: Is JLGMX a safe investment?

A: JLGMX is safer than individual stocks because it is diversified, but it still has some risk like any investment.

Q: How can I invest in JLGMX?

A: You can buy JLGMX through brokerage accounts like Fidelity, Vanguard, or Charles Schwab.

Q: Does JLGMX pay dividends?

A: Yes, JLGMX may pay dividends, but it depends on how the fund performs.

Q: What type of investor should choose JLGMX?

A: JLGMX is great for long-term investors who want steady returns without too much risk.

Q: How much money do I need to start investing in JLGMX?

A: The minimum investment amount depends on your broker, but many allow you to start with a low amount.

Go to Home Page for More Information